Wait, Why Am I Paying an Additional Medicare Tax?

By popular demand I am posting this article. I’d like to say that it’s funny, and exciting with a surprise twist. Unfortunately I can’t. But read on to understand what you can do now to reduce this tax.

The Hidden Medicare Surcharge: IRMAA

You may be surprised to learn that if your retirement income exceeds certain levels, you’ll pay additional monthly premiums (known as IRMAA—Income-Related Monthly Adjustment Amount) to the federal government for Medicare Part B and Part D.

Standard Medicare Premium in 2025

For 2025, the base premium for Medicare Part B is $185.00 per month.

This is what nearly everyone pays to the government, plus any premiums for additional coverage such as:

A Medicare Supplement plan (Medigap) plus a prescription drug plan, or

A Medicare Advantage plan.

What Is IRMAA?

IRMAA is an extra charge added to your Part B and Part D premiums if your income (Modified Adjusted Gross Income, or MAGI) exceeds certain thresholds. It is recalculated each year based on your income from two years prior.

For 2025, the Social Security Administration (SSA) uses your 2023 tax return as the reference. If your MAGI from 2023 is above the thresholds, you’ll pay higher premiums.

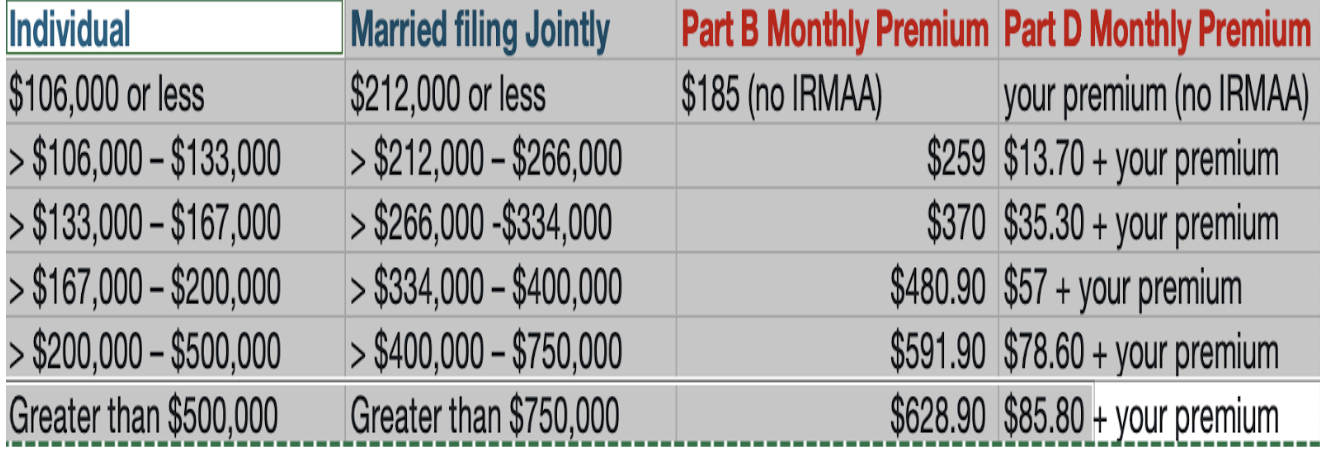

2025 IRMAA Brackets for Part B & Part D

Key Things to Note

If your MAGI exceeds the threshold by even $1, you may land in the next higher tier.

The “Additional Monthly Premium for Part D” is added on top of your standalone drug-plan premium (or whatever is built into your Medicare Advantage plan).

These surcharges are separate from whatever you pay for your Medicare Supplement or Medicare

Can You Avoid or Reduce IRMAA?

You may be able to lower your IRMAA by reducing your Modified Adjusted Growth Income (MAGI). Here are a few strategies worth discussing with your tax advisor:

Use Roth Accounts

Withdrawals from Roth IRAs or Roth 401(k)s do not count toward IRMAA, whereas withdrawals from traditional 401(k)s or IRAs do. Another reason I’m a big Roth fan.Manage Capital Gains

Capital gains count toward MAGI. When taking money from mutual funds, consider selling those with the highest cost basis, or timing distributions to minimize gains.Delay Social Security

The taxable portion of your Social Security benefits is included in MAGI. Delaying benefits until age 70 may reduce your taxable income in earlier years.Appeal IRMAA

If your income has significantly dropped since the reference year (e.g., you retired, spouse died, etc.), you can appeal the IRMAA determination. How to Appeal IRMAAWork with an Accountant or Tax Advisor

Since many factors (taxable income, tax-exempt interest, IRA distributions, etc.) affect MAGI, consult with a professional to tailor a strategy.

If you’d like to make the best Medicare decision for you or your parents watch Medicare:What the Insurance companies won’t tell you.

Medicare open enrollment ends December 7.